Google Announces First Dividend and Massive Stock Buyback

The tech sector witnessed a dramatic turnaround on Thursday, with Alphabet, Google’s parent company, leading the charge. This shift came after the company announced its first-quarter earnings report, exceeding Wall Street expectations and revealing a strategic move to reward investors.

While the broader tech market had endured sluggishly, Google defied the trend. The company reported strong financial results, exceeding analyst estimates for both revenue and profits. Revenue surpassed $80.5 billion, reflecting a 15% year-over-year increase. Profits also significantly increased, surging 57% to nearly $23.7 billion.

However, the real game-changer for Alphabet’s stock price came after hours. The company announced a double whammy for investors: a $0.20 per share cash dividend and a $70 billion share buyback program. These moves boost stock prices by directly rewarding shareholders with cash for simply holding onto their shares.

While this strategy can be effective, it has its critics. Some argue that buybacks and dividends artificially inflate stock prices without allocating resources towards employee development or core business improvements. Despite these concerns, the market responded positively. Google’s stock price jumped 13% in after-hours trading following the announcement.

AI: The Driving Force Behind Alphabet’s Success

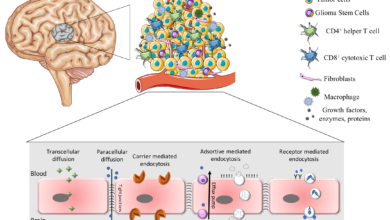

Alphabet CEO Sundar Pichai attributed the company’s success to its unwavering commitment to artificial intelligence (AI). He specifically highlighted investments in large language models and their suite of AI products, collectively known as Gemini. “We are well underway with our Gemini era, and there’s great momentum across the company,” Pichai declared. He emphasized that Google’s leadership in AI research, infrastructure, and global reach position them perfectly for the next wave of innovation in this field.

Alphabet’s strong showing serves as a potential model for the tech sector’s future. Investors seem receptive to companies strategically investing in AI, which many believe will play a defining role in the future. Notably, Pichai stressed on an analyst call that Google has “clear paths to AI monetization through ads and cloud, as well as subscriptions.”

While Google has positioned itself as a leader in the AI race, other tech giants are also making significant strides. Social media company Snap, the parent of Snapchat, reported positive earnings that surpassed analyst expectations. They achieved this by improving their advertising technology and undergoing a cost-cutting restructuring. Although they reported a net loss, it was significantly lower than the previous year. Following the release of their earnings report, Snap’s stock price skyrocketed by a staggering 25% in after-hours trading.

Similarly, Microsoft also delivered impressive earnings results. The company reported substantial revenue and profit growth, with its cloud business, Azure, experiencing a particularly significant uptick. CEO Satya Nadella pointed to the company’s investments in OpenAI’s ChatGPT technology, used in products like Copilot for Microsoft 365, as a critical driver of their success. Microsoft’s stock price responded favourably, climbing over 4% in after-hours trading.

The performance of Alphabet, Snap, and Microsoft on Thursday paints a clear picture. While the road ahead may involve potential pitfalls like overspending on AI development, there’s little doubt that companies strategically investing in this technology are reaping the rewards. As a senior director at eMarketer, Jeremy Goldman aptly stated, “Investors should keep an eye on potential AI overspending, but for now, Satya Nadella’s forward-looking strategy is building value by infusing productive intelligence across Microsoft’s entire portfolio.” The tech sector is poised for intense innovation and market competition as the battle for AI supremacy unfolds.