Nvidia: reveals it’s latest artificial intelligence chip

While competitors are trying to catch up with Nvidia, the company may be about to expand its lead with the new Blackwell B200 graphics processing unit.

Nvidia CEO Jensen Huang unveiled the new flagship AI chip (Blackwell P200) at the start of its annual developers conference on Monday.

Nvidia’s announcement of the new chip and other software during the conference will help determine whether the company can maintain its dominant position in producing and selling the chips that fueled the AI craze last year.

NVIDIA dominates the market for artificial intelligence chips for data centers, accounting for about 80 percent of the share last year.

The next technology missile… “Nvidia” threatens the market value of “Apple”.The fourth largest company in the world.. “Nvidia” overthrows Amazon and Google and approaches Aramco.

I hope you realize that this is not a concert,” Huang, wearing his distinctive black leather jacket, said after taking the stage, referring to his company’s growing fame. The P200 is the result of merging two previous Nvidia chipsets.

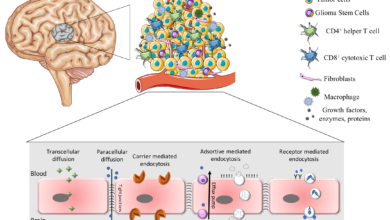

The new chip contains 208 billion transfer resistors (transistors), more than double the 80 billion contained in the company’s previous chip. All of these transistors can access the memory connected to the chip at approximately the same time, improving throughput.

Nvidia said that major customers, including Amazon.com, Alphabet Inc’s Google, MetaPlatforms, Microsoft, OpenAI, Oracle, and Tesla, are expected to use the new chip.

Jensen Huang, CEO of NVIDIA, made announcements about partnerships with design software companies Ansys, Cadence, and Synopsys. This news caused shares of the three mentioned companies to increase by approximately three percent each.

Huang’s comments likely signaled positive developments or collaborations between NVIDIA and these design software companies, which investors perceived as beneficial for their respective businesses.

From chips to systems:

NVIDIA is also shifting from selling individual chips to selling comprehensive systems. Its latest version includes 72 artificial intelligence chips and 36 central processors, contains 600,000 parts, and weighs 1,361 kilograms.

NVIDIA shares have jumped 240 percent over the past 12 months, making it the third-largest company by value on the US stock market, behind Microsoft and Apple.

This record high leaves NVIDIA shares at risk of falling again if the Santa Clara, California-based company fails to expand its artificial intelligence business to the extent investors expect.

Notably, Nvidia’s market share is anticipated to decrease in 2024 due to increased competition from rivals like Intel and Advanced Micro Devices (AMD) launching new products. This forecast suggests a shifting landscape in the graphics processing unit (GPU) market, with Intel and AMD posing stronger challenges to Nvidia’s dominance.

Despite the projected market share decline, Nvidia has seen growth in its software and services business, reaching an annual run rate of $1 billion by the end of its most recent fiscal year.

This indicates that Nvidia is diversifying its revenue streams beyond just hardware sales, potentially mitigating the impact of market share fluctuations in the GPU segment. Expanding into software and services could also provide Nvidia with additional avenues for revenue generation and business growth in the future.