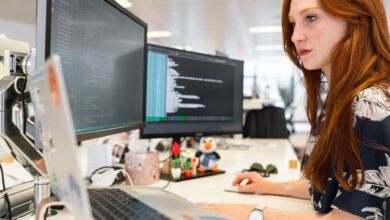

Vietnam to Benefit from Tech: Apple Promises Increased Investment

Apple’s commitment to increase component sourcing from Vietnam underscores a broader trend in the tech industry. Global companies increasingly look beyond China to diversify their supply chains, driven by cost reduction, market access, and geopolitical tensions.

Tim Cook, CEO of Apple, made this pledge during a meeting with Vietnamese Prime Minister Pham Minh Chinh in Hanoi. A statement released by the Vietnamese government revealed that Apple has invested nearly $16 billion in the country’s supply chain since 2019, creating over 200,000 jobs. Cook further expressed Apple’s commitment to “enhance cooperation and investment activities” in Vietnam.

Cook’s visit highlights Vietnam’s growing significance as an alternative manufacturing hub for global companies seeking to lessen their dependence on China. This trend, known as “China Plus One,” is fueled by the escalating trade tensions between Beijing and Western nations in recent years.

Thuy Anh Nguyen, a strategist at Dragon Capital, a Vietnamese investment firm, identifies Vietnam as a “major beneficiary” of this diversification strategy. She points to Vietnam’s significantly lower labor costs in the manufacturing sector compared to neighboring China, at roughly half the price. This advantage has enabled Vietnam to transition from primarily producing low-value goods like textiles to more tech-intensive products like iPhones and iPads. Nguyen emphasizes the importance of this shift, stating, “Those are higher-value items. That’s how we move up the value chain.”

Several factors contribute to Vietnam’s attractiveness as a manufacturing destination. Dan Ives, a senior equity analyst at Wedbush Securities, describes Vietnam as the “perfect landing spot for tech companies to diversify outside China.” He cites the country’s large pool of skilled engineers as a critical advantage. “We’re not just talking about (manufacturing of) low-cost electronics,” Ives explains. “We’re talking higher up the value chain… That was not even on the radar (of foreign companies) two years ago.”

Beyond production capabilities, Vietnam boasts a rapidly growing, educated, and youthful population. This demographic presents a compelling proposition for foreign tech companies seeking a skilled workforce and a potential consumer base. Nguyen highlights the sheer size of Vietnam’s population, stating, “Vietnam has a population of 100 million people. If it were in Europe, it would be the biggest country.” She also underscores the increasing smartphone adoption within Vietnam, further amplifying its appeal as a consumer market.

The strategic partnership between the United States and Vietnam adds another layer to the equation. The value of US imports from Vietnam has skyrocketed by over 360% in the past decade, exceeding $144 billion by the end of 2023. This economic relationship was further cemented in September 2023 when the two countries formally upgraded their diplomatic ties to a “comprehensive strategic partnership.” This move signifies Vietnam’s potential to become a crucial destination for US investment, particularly in critical technologies like semiconductor chips.

The rise of Vietnam as a manufacturing hub can also be attributed to the ongoing trade tensions between the US and China. The trade war initiated in 2018 and recent tit-for-tat chipmaking restrictions have strained the relationship between the two economic giants. Furthermore, China’s strict zero-Covid policy during the pandemic exposed the vulnerabilities associated with concentrating production in a single location. The temporary shutdown of Foxconn’s massive iPhone factory in China in 2022, triggered by worker unrest amidst Covid-19 fears, was a stark reminder of these risks.

While Vietnam offers a compelling alternative, it’s essential to acknowledge India’s market size advantage. India has also been actively wooing foreign companies, including Tesla, to establish manufacturing facilities within its borders. Analyst Dan Ives suggests that Vietnam’s current appeal is “more around supply than demand,” while India presents a more comprehensive opportunity encompassing both production and a vast domestic market.

In conclusion, Apple’s deepening ties with Vietnam signify a broader shift within the global tech industry. Companies are actively diversifying their supply chains, with Vietnam emerging as a prominent alternative manufacturing hub due to its competitive labor costs, skilled workforce, and growing consumer market.